Helping Clients Plan for Their Child’s Education

- Tashi Goenka

- Aug 11, 2025

- 4 min read

Updated: Aug 28, 2025

For many families, funding a child’s education is one of the most emotionally charged financial goals. With rising tuition costs (now averaging $36K–$55K/year) and uncertain timelines, it’s easy for clients to feel overwhelmed. As an advisor, you can bring order to this chaos by helping clients prepare without sacrificing their lifestyle as their children grow.

But it’s not just about college — it’s about the bigger picture. Education planning should be woven into the family’s overall financial roadmap. That means balancing tuition goals with other critical priorities like retirement, homeownership, or elder care. A well-integrated plan helps clients avoid overcommitting to one goal at the expense of others.

🧭 Start with Real Costs and Clear Trade-offs

The first step is aligning on goals and constraints:

How many children are you planning for?

Public vs. private education?

Just undergrad, or grad school too?

Are student loans on the table, or are we avoiding debt?

💡 Help clients go beyond the basics — model tuition inflation, student loan usage, simulate contributions from parents/grandparents, and see trade-offs between different priorities in real time.

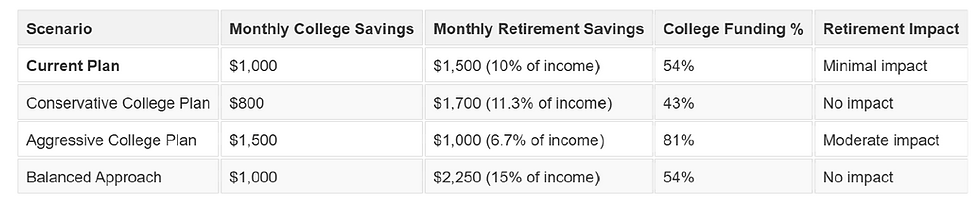

Example : “If we target $12K in annual college savings for both kids, how does that impact our retirement nest egg?”

Assumptions:

👩💼 Client Age: 35 | 💵 Household Income: $180,000/year | 👧👦 Children: Ages 4 & 2 | 💰 Current College Savings: $15,000 combined | 🎯 Monthly Contribution Goal: $1,000 combined (6.7% of income)

What This Means for the Client:

💰 Balanced Approach: $1K/month for college while still allocating 10–15% of income to retirement is feasible.

📆 Peak Pressure Window: 2041–2043 (both kids in college) will be the tightest years, but it’s temporary.

🎯 Retirement Timeline: Kids finish college when client is 57, leaving 8+ years for focused retirement saving.

📈 Recommended Retirement Savings: $1.5K/month to remain retirement-ready alongside college saving.

💡 Principle: Prioritize retirement first. Clients can’t borrow for retirement, but their kids can borrow for college.

📊 Getting the Most Out of a 529 Plan

529 plans are a powerful, tax-advantaged way to save for education — but they’re not a one-size-fits-all solution. Key features include:

Tax-deferred growth + tax-free withdrawals for qualified education

✅ Superfunding: Up to 5 years of contributions at once — $90K per donor / $180K per couple without gift tax

🕒 Early Setup: Open in a parent’s name and later assign to child

🎁 Gifting: Anyone can contribute - great for grandparents or family support

🔁 Rollover to Roth IRA: New as of 2024 - up to $35K lifetime rollover (subject to rules)

⚠️ What If You Overfund the 529?

It happens more than you'd think — maybe the child gets scholarships, chooses a less expensive school, or opts out of college altogether.

🌀 Flexible options for excess 529 funds:

Change beneficiary (e.g., to a sibling or parent)

Use for graduate school or accredited lifelong learning

Rollover up to $35K into a Roth IRA (eligibility rules apply)

Spend on niche programs — yes, even flight school ✈️, scuba diving 🤿, and culinary training 🍳

🔄 529 vs. Other Popular Education Accounts

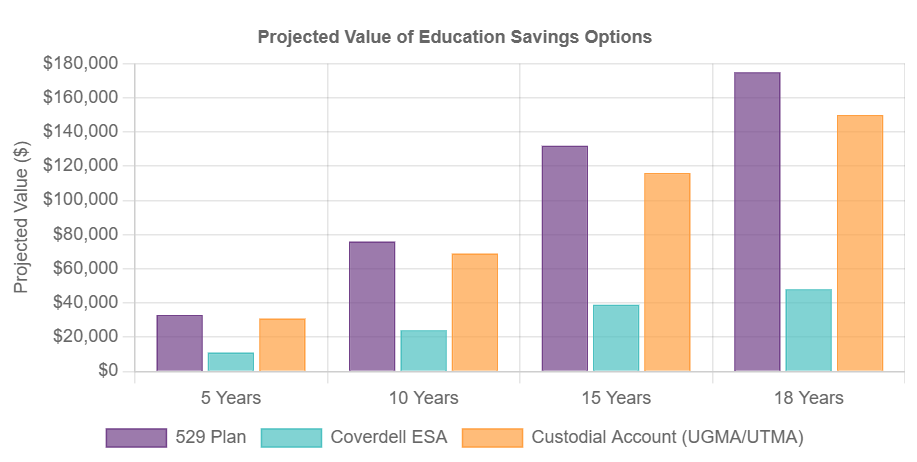

While 529s are often the go-to, they’re not the only option. Coverdell ESAs and Custodial Accounts offer different benefits, tax treatment, and flexibility.

💡 Advisor Tip: Make it simple for clients to compare savings vehicles visually and quantitatively — side by side comparisons are far more impactful than spreadsheets.

❓ How do these accounts compare for the same savings timeline?

Assumptions:

💵 Contributions: $500/month to 529 & Custodial; $167/month to Coverdell (max $2K/year)

📈 Return Assumption: 7% annual average

💸 Tax & Fees:

529 & Coverdell = Tax-free growth

Custodial = 15% tax drag

Fees: 529 (0.5%), Coverdell (0.3%), Custodial (0.2%)

⏳ Time Horizon: Shown at 5, 10, 15, and 18 years

📉 Inflation: Not included

💬 These conversations replace guesswork with clarity. Clients can see exactly what each account type could deliver.

🧱 Bonus: Trump Accounts

A new long-term savings vehicle - Trump Accounts - has entered the picture as part of the “One Big Beautiful Bill”:

💸 $1,000 federal seed per child at birth

📈 Up to $5K/year in contributions from parents, relatives, or employers

📊 Invested in a low-fee U.S. equity index fund

🎓 Funds available after age 18 for education, first homes (up to $10K), new child costs (up to $5K), small business funding, or emergencies

🧾 Tax-deferred growth; non-qualified withdrawals taxed + penalized

⚠️ Some details remain unclear as implementation guidance is pending from the administration.

🔍 Planning for Life’s “What-Ifs”

Families evolve. Jobs change, emergencies happen, and kids’ plans shift. Great advising models scenarios so clients can adjust without derailing long-term goals.

Example: A 2-Year Savings Pause Due to Job Change

📉 Impact: Pausing contributions for 2 years early in the plan can reduce the final balance by $20K (~11%). Losses are greater the earlier the pause happens due to compounding.

💵 Catch-Up Strategies: Add $100/month post-pause to recover over half the shortfall, use bonuses/tax refunds for lump sums, or extend contributions 1–2 years.

📊 Investment Adjustments: Consider a slightly more aggressive allocation during the remaining years (if risk appropriate), then rebalance to match the time horizon.

👨👩👧 Alternate Funding: Engage grandparents or relatives, redirect other short-term savings, or earmark future windfalls for education.

✅ Final Thought

🎯 Education planning is no longer just a checkbox. Done right, it’s a strategic unlock, one that strengthens your client’s trust in you and gives them peace of mind.

With the right approach and AI tools such as Wavvest's Planning Tool, you can help families model the right amount of education funding confidently without compromising their future goals.